Does my business qualify for the R&D tax credit?

Many people think large corporations are the only companies that qualify for the R&D Tax Credit. The truth is, since it was introduced, many changes have been made to the Tax Code. Now, millions of small to mid-sized businesses can reap the rewards. Work with Diligentiam on an R&D Tax Credit Study and invest back into your business.

To qualify for R&D Credits, your business must perform Qualified Research Activities that pass the IRS “Four-Part Test”:

- 01. Business Component Test

- 02. Process of Experimentation Test

- 03. Uncertainty Test

- 04. Technical in Nature Test

Call for a No-Cost Analysis and see if your business qualifies.

Free Consultation

Industries that typically

have Qualified R&D Activities

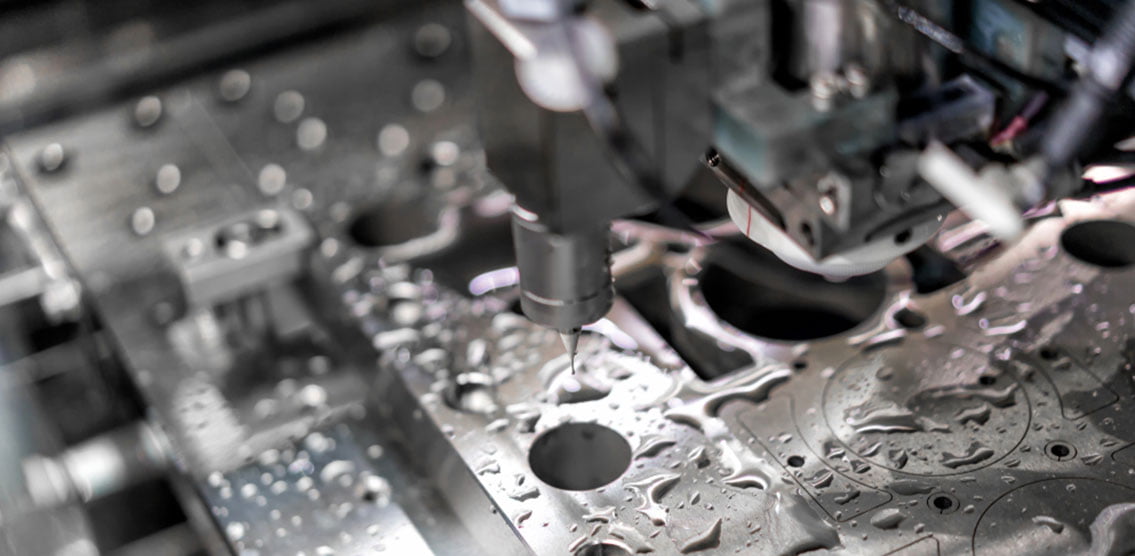

- 01. Aerospace

- 02. Automotive Industry

- 03. Bridge Building/Asphalt & Cement

- 04. Chemicals and Plastics

- 05. Consumer Plastics

- 06. Construction

- 07. Engineering

- 08. Entertainment and Media

- 09. Financial Services

- 10. Life Science

- 11. Manufacturing

- 12. Oil and Gas

- 13. Paper and Forest Products

- 14. Publishing

- 15. Retail and Textile

- 16. Semiconductor

- 17. Software

- 18. Telecommunications

This is just a sample of industries which usually qualify for the R&D Credit. If your industry is not on the list, and you think your company may have qualifying research and development activities, call our experts at Diligentiam for a free consultation to find out if your business can take advantage of the R&D Tax Credit.

Call for a No-Cost Analysis and see if your business qualifies

Call NowR&D Tax Credits Create a Culture of Innovation

Companies who employ talented individuals to create and improve products or processes are more likely to be successful than companies who follow traditional practices. An IBM 2010 Global CEO Study shows that “Leaders rank creativity as the number one leadership attribute needed for prosperity.” Advancing through the changing environments with creative innovation separates the leaders in an industry from the followers.

The R&D Tax Credit will infuse hidden dollars back into your business to create a culture of innovation. Having an R&D Tax Credit Study conducted will help you unlock this hidden cash so you can infuse it back into your business and help create a culture of collaboration and innovation. This new cash flow will provide you with a determinable forecast of funds for years to come – funds that can be spent on bringing new products to market and new revenues to your company.