What Drives Business Value?

What Drives the Value of a Business?

When seeking to grow, expand, or sell their businesses, owners often seek an opinion of value. At Diligentiam, we perform numerous valuations for firms seeking to obtain financing or attract investment for these purposes; however, we find that many business owners are unaware of the pillars of valuation that will be applied by investors during the due diligence process. As a result, many small business owners are not able to raise capital or sell their businesses for the value they had in mind. The difficulty small business owners face in these areas is represented by the historic ability for small to mid-sized businesses to sell:

-

- 93% of small to midsized businesses go to market and never sell

- Out of the 7% that do sell, 4% sell with major sellers’ concessions

- Only 3% of small to midsized businesses go to market and sell for the value desired by owners

Obviously, this inability to obtain desired investment or purchase price represents a major hurdle for small business owners looking to grow or sell their companies. As more business owners of the baby boomer generation look to transition their companies, this inability to attract capital may produce major distortions in the small business world.

Fortunately, this problem does have a diagnosis and a potential cure. It all centers on a business’s ability to decrease company-risk. In any due diligence process, investors will seek to slash the value of a firm by increasing discount rates related to perceived risk. Small businesses that can align core functions can lower perceived risk, avoid excessive discount rates, and obtain a higher investment or buyout. This article examines areas that drive the value of a business and explains how small businesses can survive the due diligence process with their values intact.

The importance of WACC for a Small Business

Our analysis starts with an examination of a key element of the due diligence process, a firm’s weighted average cost of capital (WACC). To simplify for our purposes here, WACC is an indicator of company risk represented by a percentage. The WACC formula looks at a business’s two main capital sources: debt and equity.

For investors, the higher the WACC, the riskier the investment. Most small to mid-sized businesses can’t sell or raise capital because their businesses have too high of a WACC.

In order to understand how a high WACC lowers the value of a business, an understanding of the three different approaches to how a business is valued is essential. The three different approaches are defined below.

- Asset approach – Adjusted value of the firm’s assets less its liabilities

- Market approach – Uses historic firm data and data on similar asset sales to establish value based on multiples (e.g. EBITDA, Revenue, SDE)

- Income approach- Utilizes a discounted cash flow analysis to project future earnings and determine firm value through present value of future cash flows

In most cases when a firm is looking to raise capital or sell their business, the buyer, investor, or bank is going to use the income approach to value the business. As a part of the income approach a discount rate is used to determine the present value of the future cash flows. To develop the discount rate for a firm, the most common formula used is weighted average cost of capital (WACC).

Firm’s WACC = (Cost of Equity x Weight of Equity) + (After-Tax Cost of Debt x Weight of Debt)

The higher the firm’s WACC, the higher the discount rate used in the Present Value calculation(s); therefore, the lower the firm’s value. It is important to note that high costs of capital are key drivers behind problems that small businesses face in attracting lenders and investors. Fortunately, WACC and the income approach is the one pillar that business owners have the most control over during the valuation process.

Killed by Cost of Equity

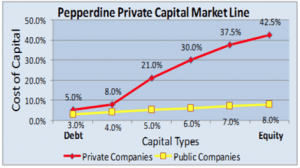

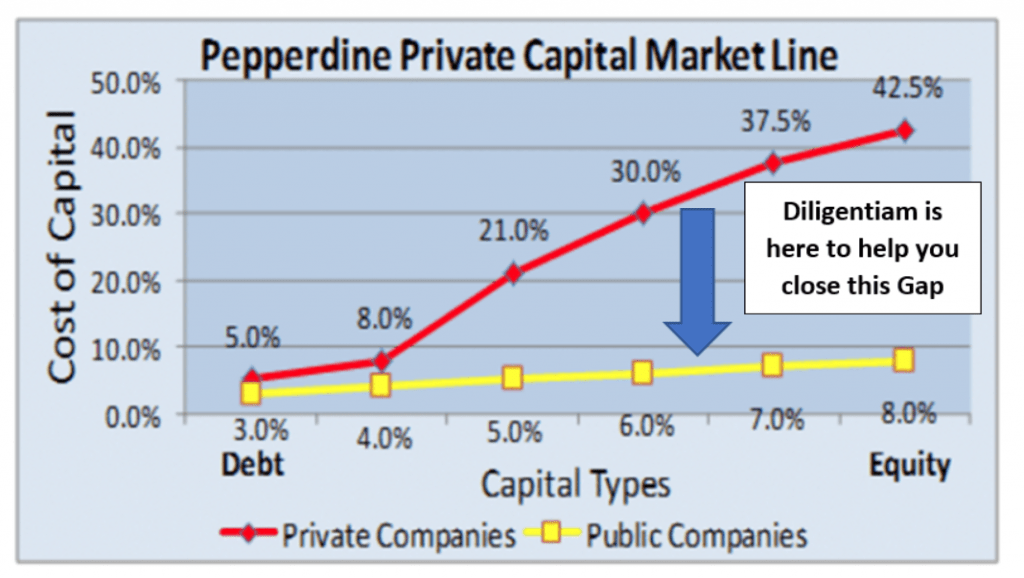

The first part of the WACC equation is the cost of equity. Most small to mid-sized businesses have a high WACC because the Cost of Equity for a small privately held company is much higher than the Cost of Equity of a public or large privately held company. Reference Graph Below.

|

Type of Capital |

Private Co.

Cost of Capital |

Public Co.

Cost of Capital |

|

Senior Debt Lending |

5% | 3% |

| Asset Based Lending | 8% |

4% |

| Mezzanine Financing | 21% |

5% |

| Private Equity Financing | 30% |

6% |

|

Venture Capital Financing |

37.5% |

7% |

| Factoring Receivables | 42.5% |

8% |

What Creates the Gap in WACC between Private and Public Companies?

Answer: Company-specific Risk

Company Specific Risk is a factor considered in the Cost of Equity of every company. The percentage of Company Specific Risk is provided after assessing all of the basic functions of the specific business looking to sell or raise capital. In the assessment process, the buyer, investor, or lender will be looking to see how each function of a business measures and aligns with the specific company’s ability to sustain continued growth. As part of this process the buyer, investor, or lender will be looking for potential fail points that could prevent the company from achieving long-term sustainable growth.

Unfortunately, many small businesses suffer under buyer, investor, and lender analysis because there is no strategy to specifically address items that investors, buyers, or lenders will assess. This leads the investor to believe that there is more Company Specific Risk within the business. Company Specific Risk is then factored into the cost of equity component, thus driving up the WACC (discount rate) and driving down the firm’s value.

The reason the public companies have lower Company Specific Risk is that they are all guided by the fundamental principle that all healthy companies have measurement and alignment across all functions of the business. Each core function of a business must be fully optimized and balanced with each other to meet peak performance and maximize value.

Alignment of each function is what investors, buyers, and lenders are assessing in the due diligence process. This simple concept has been followed by large public companies for years and is what allows them to sell at high values, raise capital, and attract investors.

In small privately held companies, the ability to measure and align all functions of the business towards achieving sustainable growth is much tougher. The main reason is that these companies do not have the resources or the understanding of what drives the value of a business in the eyes of a buyer, investor, or lender and end up stuck in the due diligence process. They may also fail to meet the expectations of the buyer, investor, or lender and are unable to sell their business or raise capital.

Therefore, understanding strategies that drive the alignment of the core functions assessed by buyers, investors, and lenders can allow a small business to sell for desired values and raise capital to support sustainable growth. At Diligentiam, we understand the pillars of the value of a business, and we have made it our mission to help small privately held companies close the cost of capital gap.

Closing the WACC gap and increasing value

The effort to close the cost of capital gap and raise the value of their business follows a multi-step system.

Step 1: Perform in-depth business valuation using the income approach

Diligentiam starts every engagement by performing an in-depth business valuation of a company using the income approach. This step provides valuable insight to the client by reviewing all of the functions of the business that would be assessed by a buyer, investor, or lender.

The goal is to provide the Intrinsic Value of the business along with a comprehensive report that analyzes each function of the business and assesses how well these functions are measured and aligned towards the goal of achieving long-term sustainable growth in the eyes of a buyer, investor, or lender. From this report, we will be able to run “what if” scenarios that show how improvements in functions of the business will raise the value of the business.

Step 1 is completed by a combination of certified business valuation analysts along with the use of value opportunity software created specifically to help companies reduce their Cost of Capital and increase the overall value of their businesses.

Step 2: Develop strategies to align core functions

Next, Diligentiam works with clients to help develop strategies to improve the functions of the business that have high-risk profiles and are driving the value of the business down.

The key to unlocking value

Selling a business or raising the capital required to move a business into the next stage of its growth could be a daunting task for any owner. Unfortunately, too often small businesses embark on the process of selling their business or raising capital and are unable to achieve their goal. However, the key that can unlock value is mitigating company-specific risk.

How to get started

If you are a business owner looking to sell your business in the next five years or looking to raise capital to transition your company into the next stage of its life, Diligentiam can help. Our consultative process helps unlock the value hidden within each business, make it shine during the due diligence process, and ultimately make the business more valuable.